Takeaways for Today (12/4/2007 and 12/5/2007)

12/4/2007 (Tuesday)

Oil settles higher waiting for OPEC

Oil prices crept back up over $88 a barrel Tuesday as traders reacted to mixed signals on whether OPEC would decide to increase production during its meeting this week.

12/5/2007 (Wednesday) Stocks jump on Fed hopes

Stocks jump on Fed hopes

Stocks rallied Wednesday, bouncing after a two-session slide, on strong economic news and bets that the Federal Reserve will cut interest rates again at its policy meeting next week.

Oil soars after OPEC keeps the supply unchanged

OPEC dashed hopes that it would step up production at its meeting Wednesday, news that sent oil prices shooting back towards the $90 a barrel mark in early trading.

Economic Data Boosts NYSE

A slew of positive economic news gave a boost to the NYSE on Wednesday, with the S&P 500 and the Dow industrials each racking up a 1.5% gain. The NYSE composite jumped 1.4%.

Chrysler Chief sees $1.6 bln losses this year

Chrysler LLC Chief Executive Robert Nardelli expects the automaker to lose $1.6 billion this year, the Wall Street Journal reported in its online edition, citing sources familiar with the matter.

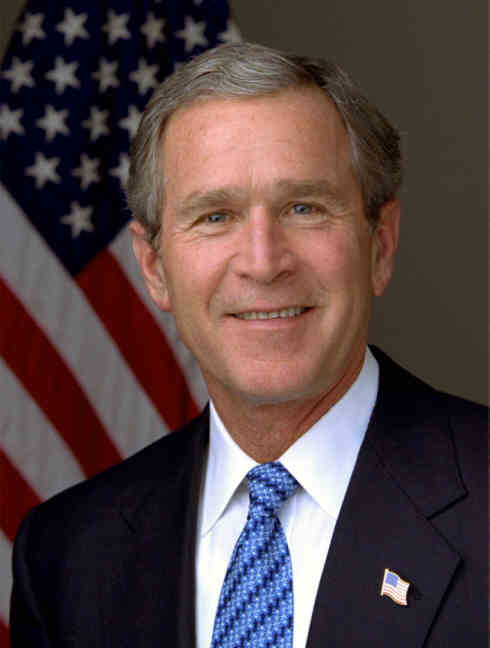

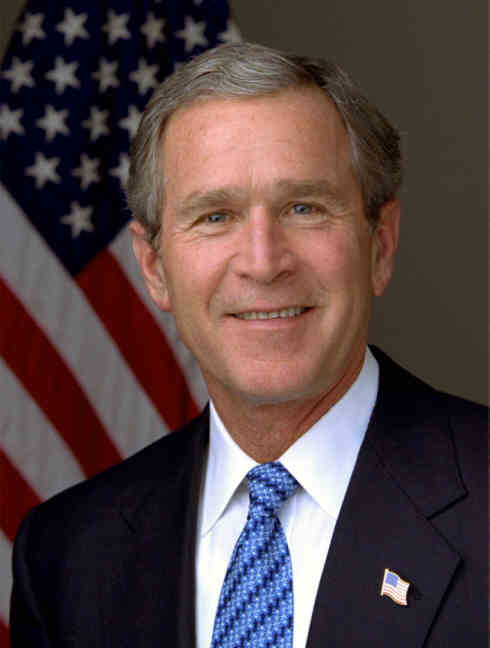

President to outline 5-year rate freeze plan

President George W. Bush is expected to outline on Thursday a plan to freeze mortgage rates for five years for many U.S. homeowners facing sharp increases in their monthly payments, industry sources said on Wednesday.

Private sector adds 189,000 jobs in Nov

Private employers added 189,000 jobs in November, a report by a private employment service said on Wednesday, much higher than market expectations and the biggest monthly increase in a year.

UBS, Goldman leads as Asia banking fee up 36 percent

Investment banking fees in the Asia Pacific region rose 36 percent to a record $11.7 billion so far this year -- roughly the gross domestic product of oil-rich Brunei -- with UBS (UBSN.VX: Quote, Profile, Research) and Goldman Sachs (GS.N: Quote, Profile, Research) the top earners.

Fannie Mae to sell $7 bln stock

Fannie Mae (FNM.N: Quote, Profile, Research) said on Tuesday it will sell $7 billion of preferred stock and slash its dividend 30 percent to shore up its capital base through 2008 as the U.S. housing slump worsens.

Ex-Morgan Stanley analysts and her husband get 18 months

A former Morgan Stanley financial analyst and her husband, an ex-hedge fund analyst at ING, were sentenced to a year and half each on Tuesday for insider trading.

Exxon Chief awarded close to $20 mln in bonus

Exxon Mobil Corp (XOM.N: Quote, Profile, Research) on Tuesday said it gave Chief Executive Rex Tillerson a cash bonus and restricted stock currently valued at close to $20 million under its short-term incentive plan for 2007.

Google looks to ad partners beyond DoubleClick

Google Inc is looking at more advertising partners outside its proposed purchase of DoubleClick Ltd and sees a move to a single system for selling ads across media taking up to five years, a top executive said on Tuesday.

Traders See 50% Odds Fed Will Cut Rate by Half Point

Odds the Federal Reserve will cut interest rates by half a point next week surpassed 50 percent for the first time, according to trading in futures contracts, reflecting concern banks face more losses on securities tied to subprime loans.

Merrill hires Financial chief

The new chief executive of Merrill Lynch, John A. Thain, made his first big move at the brokerage firm yesterday by hiring his former finance chief at the New York Stock Exchange.

Powered by Bizzcrunch

Oil settles higher waiting for OPEC

Oil prices crept back up over $88 a barrel Tuesday as traders reacted to mixed signals on whether OPEC would decide to increase production during its meeting this week.

12/5/2007 (Wednesday)

Stocks jump on Fed hopes

Stocks jump on Fed hopesStocks rallied Wednesday, bouncing after a two-session slide, on strong economic news and bets that the Federal Reserve will cut interest rates again at its policy meeting next week.

Oil soars after OPEC keeps the supply unchanged

OPEC dashed hopes that it would step up production at its meeting Wednesday, news that sent oil prices shooting back towards the $90 a barrel mark in early trading.

Economic Data Boosts NYSE

A slew of positive economic news gave a boost to the NYSE on Wednesday, with the S&P 500 and the Dow industrials each racking up a 1.5% gain. The NYSE composite jumped 1.4%.

Chrysler Chief sees $1.6 bln losses this year

Chrysler LLC Chief Executive Robert Nardelli expects the automaker to lose $1.6 billion this year, the Wall Street Journal reported in its online edition, citing sources familiar with the matter.

President to outline 5-year rate freeze plan

President George W. Bush is expected to outline on Thursday a plan to freeze mortgage rates for five years for many U.S. homeowners facing sharp increases in their monthly payments, industry sources said on Wednesday.

Private sector adds 189,000 jobs in Nov

Private employers added 189,000 jobs in November, a report by a private employment service said on Wednesday, much higher than market expectations and the biggest monthly increase in a year.

UBS, Goldman leads as Asia banking fee up 36 percent

Investment banking fees in the Asia Pacific region rose 36 percent to a record $11.7 billion so far this year -- roughly the gross domestic product of oil-rich Brunei -- with UBS (UBSN.VX: Quote, Profile, Research) and Goldman Sachs (GS.N: Quote, Profile, Research) the top earners.

Fannie Mae to sell $7 bln stock

Fannie Mae (FNM.N: Quote, Profile, Research) said on Tuesday it will sell $7 billion of preferred stock and slash its dividend 30 percent to shore up its capital base through 2008 as the U.S. housing slump worsens.

Ex-Morgan Stanley analysts and her husband get 18 months

A former Morgan Stanley financial analyst and her husband, an ex-hedge fund analyst at ING, were sentenced to a year and half each on Tuesday for insider trading.

Exxon Chief awarded close to $20 mln in bonus

Exxon Mobil Corp (XOM.N: Quote, Profile, Research) on Tuesday said it gave Chief Executive Rex Tillerson a cash bonus and restricted stock currently valued at close to $20 million under its short-term incentive plan for 2007.

Google looks to ad partners beyond DoubleClick

Google Inc is looking at more advertising partners outside its proposed purchase of DoubleClick Ltd and sees a move to a single system for selling ads across media taking up to five years, a top executive said on Tuesday.

Traders See 50% Odds Fed Will Cut Rate by Half Point

Odds the Federal Reserve will cut interest rates by half a point next week surpassed 50 percent for the first time, according to trading in futures contracts, reflecting concern banks face more losses on securities tied to subprime loans.

Merrill hires Financial chief

The new chief executive of Merrill Lynch, John A. Thain, made his first big move at the brokerage firm yesterday by hiring his former finance chief at the New York Stock Exchange.

Powered by Bizzcrunch