Takeaways for Today (12/6/2007 and 12/7/2007)

Saturday, December 8, 2007 by David Choi

12/6/ 2007

Stock rallies, day 2

Stock rallies, day 2

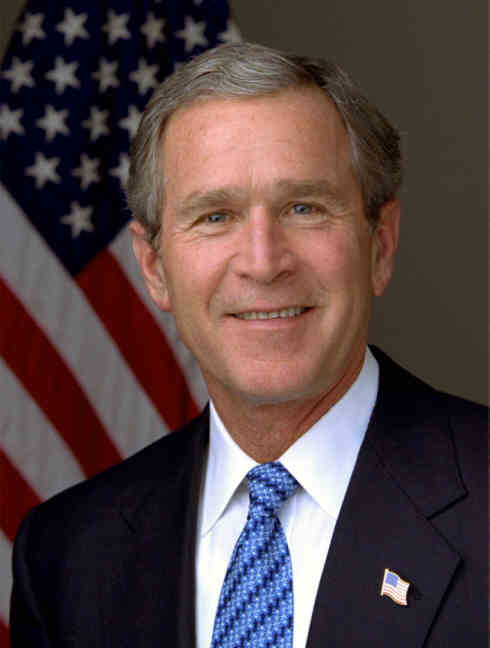

Stocks rallied Thursday afternoon, gaining for the second session in a row, as investors welcomed the White House's plan to help troubled homeowners and geared up for Friday's jobs report and next week's Fed policy meeting.

Rio Chief Claims BHP Proposal "Dead in the Water"

Rio Tinto Ltd/Plc (RIO.AX: Quote, Profile, Research) (RIO.L: Quote, Profile, Research) Chief Executive Tom Albanese said on Friday BHP Billiton Ltd/Plc's (BHP.AX: Quote, Profile, Research) (BLT.L: Quote, Profile, Research) $140 billion takeover proposal to assemble super mining house was now "dead in the water."

Palm warns of loss

Palm Inc (PALM.O: Quote, Profile, Research) warned on Thursday that it will post a loss for the quarter ended November 30 as revenue fell short due to a product delay, driving the company's shares down 16.5 percent.

12/7/2007

Wall St. wary ahead of Fed's Meeting

Wall St. wary ahead of Fed's Meeting

Stocks struggled for direction Friday as investors welcomed a mostly upbeat November jobs report and geared up for an expected interest rate cut from the Federal Reserve.

Wall St. Ends Flat on oil and jobs; eyes on Fed

Stocks ended little changed on Friday as a sharp drop in oil prices and signs of resiliency in the labor market offset concerns that tighter credit is hurting consumer spending.

S&P Cuts Capital Notes of 13 SIVs, More Cuts Possible

Standard & Poor's said it lowered credit ratings on capital notes of 13 structured investment vehicles and placed debt of 18 SIVs on negative outlook as the funds struggle to finance themselves.

U.S. sees job growth, but rate cut still likely

The number of jobs in the United States swelled more than expected last month. The favorable economic data, however, probably will not enough to dissuade the Federal Reserve from cutting interest rates Tuesday.

Oil and gas companies' expense seen up: Lehman

Global spending on exploration and production by oil and natural gas companies is expected to rise more than 11 percent to $369 billion in 2008, fueled by investment outside North America, according to a survey by Lehman Brothers released on Friday.

Chrysler to recall more than 575,000 vehicles

Chrysler LLC said on Friday it would recall 575,417 vehicles as long-term wear on the gear shift assembly could cause them to shift out of park without the key in the ignition.

ConocoPhilips to set 13% spending hike in 2008

ConocoPhillips (COP.N: Quote, Profile, Research), the third-largest U.S. oil company, said on Friday its 2008 capital spending would total $15.3 billion, an increase of about 13 percent from the top end of its expected 2007 budget.

New IMF chief plans to cut up to 15 percent of staff

The new head of the International Monetary Fund plans to cut up to 15 percent of the organization's staff in an attempt to stabilize the fund's finances as demand for its loans drops, the Wall Street Journal reported on Friday.

CompUSA to close after holidays

CompUSA, the computer retailer that Mexican billionaire Carlos Slim owned since 2000, will shut its doors after 23 years, succumbing to competition from Best Buy Co. and Wal-Mart Stores Inc.

Citigroup is close to picking a new CEO

Citigroup is scheduled to hold its year-end board meetings early next week, where its directors could decide on a new chief executive, according to people briefed on the search process.

Powered by Bizzcrunch

Stock rallies, day 2

Stock rallies, day 2Stocks rallied Thursday afternoon, gaining for the second session in a row, as investors welcomed the White House's plan to help troubled homeowners and geared up for Friday's jobs report and next week's Fed policy meeting.

Rio Chief Claims BHP Proposal "Dead in the Water"

Rio Tinto Ltd/Plc (RIO.AX: Quote, Profile, Research) (RIO.L: Quote, Profile, Research) Chief Executive Tom Albanese said on Friday BHP Billiton Ltd/Plc's (BHP.AX: Quote, Profile, Research) (BLT.L: Quote, Profile, Research) $140 billion takeover proposal to assemble super mining house was now "dead in the water."

Palm warns of loss

Palm Inc (PALM.O: Quote, Profile, Research) warned on Thursday that it will post a loss for the quarter ended November 30 as revenue fell short due to a product delay, driving the company's shares down 16.5 percent.

12/7/2007

Wall St. wary ahead of Fed's Meeting

Wall St. wary ahead of Fed's MeetingStocks struggled for direction Friday as investors welcomed a mostly upbeat November jobs report and geared up for an expected interest rate cut from the Federal Reserve.

Wall St. Ends Flat on oil and jobs; eyes on Fed

Stocks ended little changed on Friday as a sharp drop in oil prices and signs of resiliency in the labor market offset concerns that tighter credit is hurting consumer spending.

S&P Cuts Capital Notes of 13 SIVs, More Cuts Possible

Standard & Poor's said it lowered credit ratings on capital notes of 13 structured investment vehicles and placed debt of 18 SIVs on negative outlook as the funds struggle to finance themselves.

U.S. sees job growth, but rate cut still likely

Oil and gas companies' expense seen up: Lehman

Global spending on exploration and production by oil and natural gas companies is expected to rise more than 11 percent to $369 billion in 2008, fueled by investment outside North America, according to a survey by Lehman Brothers released on Friday.

Chrysler to recall more than 575,000 vehicles

Chrysler LLC said on Friday it would recall 575,417 vehicles as long-term wear on the gear shift assembly could cause them to shift out of park without the key in the ignition.

ConocoPhilips to set 13% spending hike in 2008

ConocoPhillips (COP.N: Quote, Profile, Research), the third-largest U.S. oil company, said on Friday its 2008 capital spending would total $15.3 billion, an increase of about 13 percent from the top end of its expected 2007 budget.

New IMF chief plans to cut up to 15 percent of staff

The new head of the International Monetary Fund plans to cut up to 15 percent of the organization's staff in an attempt to stabilize the fund's finances as demand for its loans drops, the Wall Street Journal reported on Friday.

CompUSA to close after holidays

CompUSA, the computer retailer that Mexican billionaire Carlos Slim owned since 2000, will shut its doors after 23 years, succumbing to competition from Best Buy Co. and Wal-Mart Stores Inc.

Citigroup is close to picking a new CEO

Citigroup is scheduled to hold its year-end board meetings early next week, where its directors could decide on a new chief executive, according to people briefed on the search process.

Powered by Bizzcrunch