|

Friday, November 30, 2007 by David Choi

Blue chips get Bernanke boost Blue chips get Bernanke boostBlue chips gained Friday in a choppy session in which investors welcomed comments from Fed Chair Ben Bernanke that implied further interest rate cuts are on the way but showed some caution after a three-day advance.

Oil prices fell below $89Oil prices fell Friday on expectations that OPEC will decide to increase output at its meeting next week and as concerns of a supply disruption from a U.S. pipeline fire abated.

Gold futures end lower; lose over $42 on the weekGold for February delivery fell $13.20 to end at $789.10 an ounce on the New York Mercantile Exchange. Gold futures posted a weekly loss of $42.70, significantly down from last Friday's closing level of $831.80.  Morgan Stanley may face $5.7 billion write-downs Morgan Stanley may face $5.7 billion write-downsMorgan Stanley (MS.N: Quote, Profile, Research) may face a fiscal fourth-quarter write-down of as much as $5.7 billion for mortgage-related losses, CNBC television said on Friday.  Citi cuts assets of sponsored SIVs by $17 billion Citi cuts assets of sponsored SIVs by $17 billionCitigroup Inc. said late Friday that it has reduced the assets of structured investment vehicles it advises by $17 billion in the past two months, as the banking giant tries to maneuver through this year's subprime thicket.  UBS Financial Rating Cut by Moody's on Subprime Loss UBS Financial Rating Cut by Moody's on Subprime LossUBS AG, Europe's biggest bank by assets, had its financial-strength rating cut by Moody's Investors Service for the first time since 1998 because of concern about losses from U.S. subprime-mortgage securities.  Warner Music's Profit Slips 58% as Industry Struggles Warner Music's Profit Slips 58% as Industry StrugglesThe Warner Music Group said yesterday that its fourth-quarter profit slipped 58 percent amid a softer international market and a decline in compact disc sales. Its results, however, topped Wall Street estimates. Powered by Bizzcrunch

| » | »

Sphere: Related Content

Thursday, November 29, 2007 by David Choi

Markets manage advance Markets manage advanceStocks struggled higher Thursday, at the end of a bumpy session in which investors mulled weak home sales and mixed corporate news ahead of a key speech from Fed chairman Ben Bernanke in the evening.

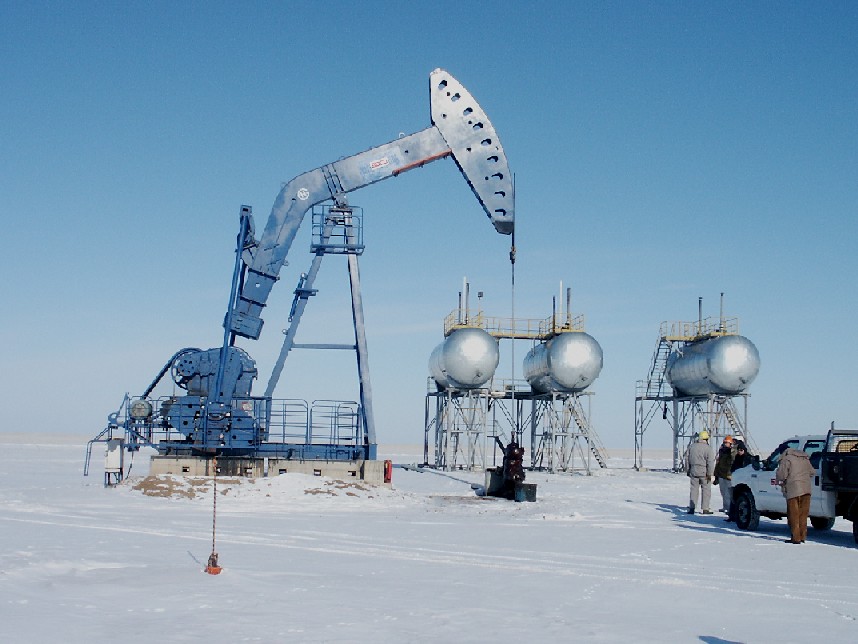

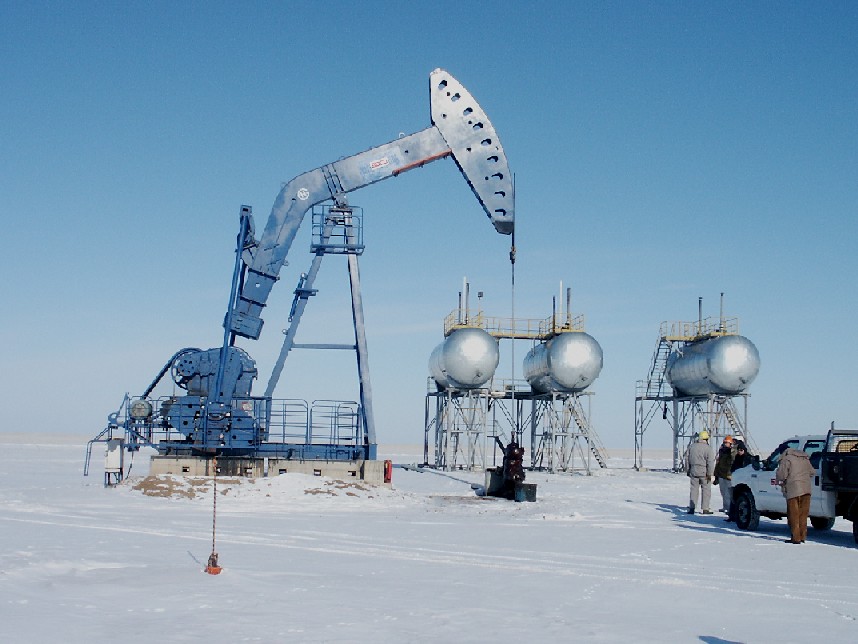

Oil jumps $4 after pipeline blastCrude oil climbed $4.55 in early trading to $95.17 amid fears the pipeline which feeds Canadian crude to refineries in the US Midwest had been crippled ahead of the peak winter season. The pipeline system has the capacity to supply 20 per cent of US crude imports.  Gold closes down below $800 amid dollars gain Gold closes down below $800 amid dollars gainGold futures finished below $800 an ounce on Thursday, as gains in the U.S. dollar squeezed demand for the precious metal. Gold for December delivery fell $5 to finish at $795.30 an ounce on the New York Mercantile Exchange.  Bernanke signals financial strains dimming outlook Bernanke signals financial strains dimming outlookFederal Reserve Chairman Ben Bernanke said on Thursday a resurgence in financial strains in recent weeks had dimmed the outlook for the U.S. economy, signaling an openness to lowering interest rates again. Fed will protect economy; not the individualsThe Federal Reserve will act to protect the wider economy from financial turmoil but not to shelter individual investors from losses, Fed Board Governor Frederic Mishkin said on Thursday.  U.S. Says China Agrees to End Some Sudsidies U.S. Says China Agrees to End Some SudsidiesBowing to American pressure on the eve of high-level talks to reduce economic tensions, China agreed today to end a dozen subsidies that promote exports and discourage imports of steel, wood products, information technology and other manufactured goods.

Banks, US near deal to freeze subprime ratesThe Bush Administration is close to agreeing on a pact with major financial institutions that would temporarily freeze interest rates on certain subprime loans, the Wall Street Journal reported Friday, citing sources familiar with the negotiations.  Google ready to bid on mobile airwaves Google ready to bid on mobile airwavesGoogle Inc was set to announce on Friday it will bid on coveted airwaves to launch a U.S. wireless network, the Wall Street Journal reported on Thursday, citing sources familiar with the matter.  Sprint Nextel Corp (S.N: Quote, Profile, Research) has rejected a $5 billion investment by a group including former chairman Tim Donahue, South Korea's SK Telecom Co Ltd (017670.KS: Quote, Profile, Research) and Providence Equity Partners, a source familiar with the matter said on Thursday.  Dell profits rise; but outlook remains murky Dell profits rise; but outlook remains murkyDell's shares fell more than 10% in after-hours trading, as the maker of PCs and server gear warned that future earnings could be hurt by shifts in the market, though it declined to give an exact forecast.  Sears Holding profit tumbles on declining sales Sears Holding profit tumbles on declining salesSears Holdings Corp.'s quarterly profit tumbled 99% after declining sales at both its Kmart and Sears chains led to steep discounts, and the company said Thursday it doesn't anticipate any significant near-term improvement. Shares dropped to a 2 1/2-year low.  Morgan Stanley's Cruz Replace After Mortgage Losses Morgan Stanley's Cruz Replace After Mortgage LossesZoe Cruz, co-president of Morgan Stanley and Wall Street's highest-paid female executive, was ousted three weeks after the firm disclosed $3.7 billion of losses on mortgage-related securities at the division she oversaw. Powered by Bizzcrunch

| » | »

Sphere: Related Content

Wednesday, November 28, 2007 by David Choi

Stocks surge after Fed comments Stocks surge after Fed commentsStocks surged Wednesday, with the Dow industrials rallying 331 points, after comments from a Federal Reserve official sparked bets that the central bank will cut rates again at its next policy meeting.  Fed Comments Lift Stock Futures Fed Comments Lift Stock FuturesStock futures pointed to a strong open Wednesday, thanks to Fed Vice Chairman Donald Kohn's rate cut hints. Nasdaq futures climbed 28 points vs. fair value, S&P 500 futures gained 11 points and Dow futures rallied 81 points.  Oil price dips nearly $4 Oil price dips nearly $4 Oil prices fell nearly $4 Wednesday, adding to steep losses Tuesday, on a healthier-than-expected U.S. inventory report and speculation OPEC will boost production.

Economic growth eased as home demand fellEconomic growth slowed in October and the first half of November as a glut of homes for sale pushed home prices down and tighter credit took some would-be buyers out of the market, the Federal Reserve said on Wednesday.

Existing home sales drop to record low in OctExisting home sales fell 1.2 percent in October to a record low 4.97 million-unit pace, according to a report on Wednesday that showed the downturn in the U.S. housing market was deepening.

Freddie Mac shares post biggest gain in 19 yearsShares of Freddie Mac (FRE.N: Quote, Profile, Research) surged on Wednesday as strong demand for a record preferred stock issue signaled the second-biggest provider of U.S. home funding could access capital even in turbulent markets.  Bear Stearns to cut 650 jobs globally Bear Stearns to cut 650 jobs globallyBear Stearns Cos Inc (BSC.N: Quote, Profile, Research) said on Wednesday it would cut 650 jobs, or 4 percent of its global work force, as the investment bank braces to lose money in the fourth quarter due to bad bets on subprime mortgages.  Yahoo and Adobe team on PDF ads Yahoo and Adobe team on PDF adsYahoo and Adobe are bringing pay-per-click ads to Adobe's Portable Document Format so that publishers can serve up ads inside PDFs distributed on Web sites and over e-mail that are contextually relevant to the content. Porsche optimistic about earnings after sales increasePorsche SE, the maker of the 911 sports car, said sales rose 15 percent in the last four months and that it's ``carefully optimistic'' about full-year earnings growth.

Japanese automakers raise production outputToyota, Honda and Nissan, the three largest carmakers in Japan, increased production in October on rising overseas demand. Toyota, the biggest Japanese automaker, increased global production 16 percent to 821,003 vehicles in October, and Honda's output rose 13 percent to 363,532 vehicles, the companies said in separate statements Tuesday. Powered by Bizzcrunch

| » | »

Sphere: Related Content

Tuesday, November 27, 2007 by David Choi

Stock Bounces Back Stock Bounces BackStocks rose Tuesday, reclaiming most of the day's gains at the end of a choppy afternoon in which investor enthusiasm for recently battered shares was tried by ongoing worries about the economy.

Crude Oil Slumps as Production Fears; Slowing Economic Growth also weighsU.S. crude oil futures fell more than $3 a barrel on Tuesday, pressured by the possibility of an OPEC production increase when the group meets next week and sliding consumer confidence that could signal slower demand.  Top economic adviser to leave White House Top economic adviser to leave White House The resignation of Hubbard, 60 years old, is expected to be announced as soon as Wednesday, according to a report in the Wall Street Journal. Hubbard will follow out the door this year, political advisor, Karl Rove, communications chief Dan Bartlett, and budget director Rob Portman, among others. Hubbard's departure comes in unfortunate timing for the government, which is facing an economic crisis triggered by woes in the mortgage industry that has also resulted in rising foreclosures and worries about recession.

December Fed rate cut seen as virtual certainty The rhetoric continued Tuesday with two Federal Open Market committee members expressing no desire to move rates from their current 4.5% level. But despite the line in the sand, Fed watchers are convinced there will be a quarter-point rate cut at the next meeting on Dec. 11. And the financial markets, based on Fed funds futures trading, is just as certain of a rate cut.

Well Fargo sets aside $1.4 billion to cover lossesWells Fargo & Co., the second-largest U.S. mortgage lender, said late Tuesday that it will set aside $1.4 billion during the fourth quarter to cover higher losses on home-equity loans caused by deterioration in the real-estate market.

Verizon's move can tear down the "walled garden"Verizon on Tuesday said that by the end of 2008 it plans to give customers more choice over the phones they use and the software that runs on them. In effect, its wireless business would become like the World Wide Web instead of the closed model of the existing phone industry.  Freddie Mac cuts dividend, slates $6 billion preferred Freddie Mac cuts dividend, slates $6 billion preferredFreddie Mac (FRE.N: Quote, Profile, Research), the second largest provider of financing for U.S. home loans, on Tuesday said it halved its quarterly dividend and will sell $6 billion in preferred stock to bolster capital in anticipation of mounting mortgage-related losses.  China Rejects Europe's Call for Currency to Rise Faster China Rejects Europe's Call for Currency to Rise FasterChina signaled Tuesday that it would resist European demands for rapid appreciation of the yuan and would instead continue gradual progress toward a more flexible exchange rate.  Google's Next Frontier: Renewable Energy Google Google's Next Frontier: Renewable Energy Google, the Internet company with a seemingly limitless source of revenue, plans to get into the business of finding limitless sources of energy. The company, based in Mountain View, Calif., announced Tuesday that it intended to develop and help stimulate the creation of renewable energy technologies that are cheaper than coal-generated power. Powered by Bizzcrunch

| » | »

Sphere: Related Content

Monday, November 26, 2007 by David Choi

Stock Market Turns Lower Stock Market Turns Lower Stock selling accelerated Monday afternoon, as a mostly positive start to the holiday sales period was overshadowed by further worries about the impact of the credit and mortgage market fallout on the economy. Metals Rise as Investors await U.S. data; Oil Price EaseMore bullish buying propped up precious and base metals prices Monday as U.S. markets returned from the long Thanksgiving weekend, while energy and agricultural markets turned soft on profit-taking.

Treasury Rates Sinked to 3 1/2 As Credit Concerns RiseU.S. Treasuries surged on Monday, with benchmark yields reaching a more than 3 1/2-year low as increasing credit market strains caused investors to seek the relative safety of government bonds.  Citigroup shares below $30 Citigroup shares below $30Citigroup Inc (C.N: Quote, Profile, Research) shares fell below $30 for the first time in more than five years on Monday, amid mounting concern about mortgage losses and possible further job cuts at the largest U.S. bank by assets. Citigroup planning major job cutsCitigroup, the No. 1 U.S. bank by assets, is planning major job cuts over the coming months, CNBC television reported on Monday.  For Abu Dhabi and Citi, Credit Crisis Drove Deal For Abu Dhabi and Citi, Credit Crisis Drove DealA falling dollar, a growing pile of oil revenue and an interest in not being overshadowed by neighboring Dubai’s increasingly high profile spurred Abu Dhabi to break with its low-key investing tradition to purchase a big $7.5 billion stake in Citigroup.  E*Trade shares fall on credit woes E*Trade shares fall on credit woesE*Trade Financial Corp (ETFC.O: Quote, Profile, Research) shares fell sharply on Monday as investors became skeptical the online brokerage can escape its credit woes with a merger, or by selling part of its business.  HSBC backs SIVs with $35 billions HSBC backs SIVs with $35 billionsHSBC Holdings Plc, Europe's biggest bank, has stepped in to support its two structured investment vehicles -- Cullinan and Asscher -- with funding of up to $35 billion to prevent forced sales of assets. Fed set to provide extra liquidity into 2008The Federal Reserve said on Monday it will conduct a series of term repurchase agreements extending into the new year in response to heightened pressures in money markets. The Fed said the first operation for about $8 billion is set for November 28, to mature January 10, 2008. Powered by BizzcrunchLabels: Takeaways for Today

| » | »

Sphere: Related Content

by David Choi

Subprime gives fund return of 1000% Subprime gives fund return of 1000%A Californian hedge fund has made a more than 1,000 per cent return this year by betting against US subprime home loans, making it one of the world's best-performing funds of all time.

China's Citic Securities eyes HK ListingCitic Securities, China’s largest securities firm by market capitalisation, is considering listing in Hong Kong in the wake of its pioneering joint venture agreement with Bear Stearns, the US investment bank. Citic’s deal with Bear Stearns is awaiting approval from regulators, but the two companies have announced their intention to invest in each other through an exchange of convertible securities and the set-up of a joint venture in Hong Kong.  Profit combined with pain in Airbus China deals Profit combined with pain in Airbus China dealsEuropean planemaker Airbus wore two masks in China on Monday -- the joy of landing what could be its biggest ever aircraft order by volume, contrasted with growing despair over the plunging value of the dollar.  China unhappy with EU's product safety call China unhappy with EU's product safety callThe top EU trade official told China on Monday its reputation was at risk after a series of product safety scandals and that it must do more to tackle the problem. The comments drew an icy response from a senior Chinese minister.  Chinese Ministry Urges Joint Efforts on Fuel Shortage Chinese Ministry Urges Joint Efforts on Fuel ShortageChina's Ministry of Commerce pushed for joint efforts from local agencies and major oil refineries to stabilize the supply of oil products as the country's energy shortage continues.  96,000 pounds of beef recalled 96,000 pounds of beef recalled American Foods Group, based in Green Bay, Wis., has recalled 95,927 pounds of ground beef potentially contaminated with E. coli after two people who ate the meat got sick, the U.S. Department of Agriculture said. Powered by Bizzcrunch

| » | »

Sphere: Related Content

Saturday, November 24, 2007 by David Choi

Dow cashes in Black Friday despite weak volume Dow cashes in Black Friday despite weak volumeStocks rallied in light trading Friday, with the Dow closing up more than 180 points, as investors sought deals in the battered financial sector and retailers got a bounce out of Black Friday shopping. Stocks perked up in a Black Friday-shortened session, as retailers and financials led the way.

Oil posts closing record to $98.18Oil futures resumed their march toward $100 a barrel Friday, rising to a new record settlement in light holiday trading on concerns about tight heating oil supplies while also drawing support from a buoyant stock market.

Dollar hits new low against EuroThe dollar hit a new low against the euro in thin trading Friday as speculation continued that the American credit crisis will lead to another cut in interest rates in the U.S.

Gold piles on gain amid dollar weaknessGold futures rose for a third day, closing up $26 an ounce in an abbreviated post-holiday session after the dollar touched a new low against the euro, increasing the value of gold as an investment safe haven.  Greenspans says flexibility cut possibilities of recession Greenspans says flexibility cut possibilities of recessionThe economy's great flexibility has reduced the risk of recession from the subprime mortgage crisis, former Federal Reserve Chairman Alan Greenspan said on Friday.  EADS says weak dollars threatens Airbus EADS says weak dollars threatens AirbusThe sharp decline of the U.S. dollar poses an "existential" long-term threat to Airbus that will force it to shift production to dollar-zone countries and rein in development plans, the head of Airbus parent EADS said.  Freddie Mac to raise $5 bln in preferred stock sale Freddie Mac to raise $5 bln in preferred stock saleFreddie Mac (FRE.N: Quote, Profile, Research), the U.S. mortgage finance company that stunned Wall Street with a $2 billion quarterly loss earlier this week, plans to sell $5 billion of preferred stock in a deal to be launched as early as next week, the Wall Street Journal said on Friday.

E*Trade may be in talks with other brokersOnline brokerage E*Trade Financial Corp (ETFC.O: Quote, Profile, Research) is believed to be in merger talks with Charles Schwab Corp (SCHW.O: Quote, Profile, Research) and TD Ameritrade Holding Corp (AMTD.O: Quote, Profile, Research), according to a report on Friday on business news channel CNBC. Online Retailers roll out sales for "Cyber Monday"Consumers are expected to plant themselves at their computers and make online holiday purchases Monday, a day that has become increasingly important to retailers and shoppers alike.  EU officials to talk tough on trade in China EU officials to talk tough on trade in ChinaTop European Union officials will talk tough in Beijing next week about China's snowballing trade surplus and its reluctance to open its booming economy further to European business. Powered by Bizzcrunch

| » | »

Sphere: Related Content

|

|

Blue chips get Bernanke boost

Blue chips get Bernanke boost